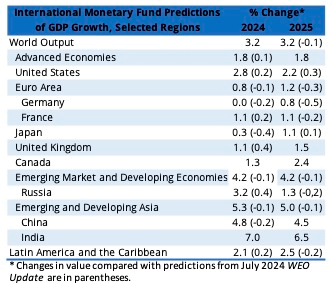

Since April of this year, the International Monetary Fund (IMF) has projected a consistent picture of the global economy, forecasting GDP growth of 3.2% in 2024 and 2025. However, in its October 2024 World Economic Outlook (WEO): Policy Pivot, Rising Threats, the IMF reports revisions to the outlook for a number of economies as well as changes in policy the institution deems necessary for “a smooth landing” and to increase growth potential.

Among the revisions (please see table below) are upgrades to the US forecast—a consequence of higher nonresidential investment and consumption (resulting from wage growth) than expected—and downgrades to those of other advanced economies, especially large European countries; manufacturing remains weak in Germany and Italy. In Japan, a temporary supply disruption in the auto industry was responsible for a 2024 growth dip, whereas in the UK, domestic demand rose with falling inflation and interest rates. Downward revisions in emerging market and developing economies were prompted by civil unrest, conflict, production and shipping disruptions of commodities (especially oil), and extreme weather events affecting Central Asia, the Middle East, and sub-Saharan Africa. Russia’s upward revision in 2024 reflects high prices for oil and gas revenues. In developing Asia, high demand for electronics and semiconductors helped to mitigate the decline. In China, persistent weakness in the real estate sector and low consumer confidence were offset by high net exports.

In 2025, US growth is expected to slow on account of a cooling labor market and fiscal tightening. In Europe, rising real wages will increase consumption, and loosening monetary policy will encourage more investment. Similarly, gains in real wages will prompt stronger consumption in Japan. Growth is predicted to slow down in China and India—the latter resulting from exhausting pent-up demand. Although the effects of supply disruptions and weather events in emerging market and developing economies are projected to ease in 2025, the ongoing conflict in Sudan is threatening the collapse of South Sudan’s economy, and activity has been weak in Nigeria. In Russia, consumption, investment, and wage growth are all anticipated to slow.

Global headline inflation has fallen notably and is expected to decline further, from 5.8% in 2024 to 4.3% in 2025, with advanced economies reaching their inflation targets sooner than emerging markets and developing economies will. The global economy has proven to be resilient over the course of disinflation thus far, but the IMF warns of rising downside risks to its outlook. They include financial market volatility (with impacts on sovereign debt markets), protraction of tight monetary policy, intensifying of China’s slowdown in growth, the implementation of protectionist policies, and the ramping up of regional conflicts.

The IMF describes its prescribed changes as a “policy triple pivot”, the first of which, on monetary policy, is in progress. The central banks of many advanced economies have been moving their policy stance toward neutral by cutting their policy rates. This is helping to lessen the pressure on the economies of emerging markets and strengthening their currencies against the US dollar, better supporting disinflation in these countries. However, inflation in services remains high, and some emerging market economies are experiencing high food prices, resulting again in inflationary pressure.

Fiscal policy is the second area in which the latest WEO calls for a pivot, such that lower policy rates will decrease funding costs. This will help to stabilize debt-to-GDP ratios and enable building of fiscal buffers against shocks stemming from events such as natural disasters, pandemics, climate effects, and geopolitical conflicts. The IMF states that this must be implemented gradually, with adjustments over several years, and, in some cases, accompanied by additional actions, such as decreasing the disparities between revenues and expenditures.

The third pivot is in structural reforms to increase productivity and prospects for growth. Faced with such challenges as aging or declining populations (in some countries), young and growing populations seeking opportunities (in others), and undergoing the climate transition, the IMF argues for the necessity of “domestic reforms that boost technology and innovation, improve competition and resource allocation, further economic integration, and stimulate productive private investment” to raise growth potential.

The reining in of inflation and the performance of the US economy in 2024 are positive signs for the analytical instrument industry, whose dynamics typically lag 6–12 months behind those of the overall economy. Many customers have been holding off on making large purchases in 2024, with some indication that this will change in the coming year. In addition, a number of industries (e.g., pharmaceutical, semiconductor, steel) have forecast positive growth in 2025, which may prompt increased need for analytical instruments.